Ford Insure

![[image]](https://radius-cdn.ramp.indiqator.com.au/_radius/image?url=https%3A%2F%2Fradius-cdn.ramp.indiqator.com.au%2Fassets%2Fuploads%2Fsites%2F6151%2F2025%2F06%2FIllustration-04-720x405-1-720x405-1.webp&w=3840&q=75)

Ford Genuine Parts maintain the integrity of your car by ensuring it performs the way it’s meant to.

It’s the same with Ford Insure.

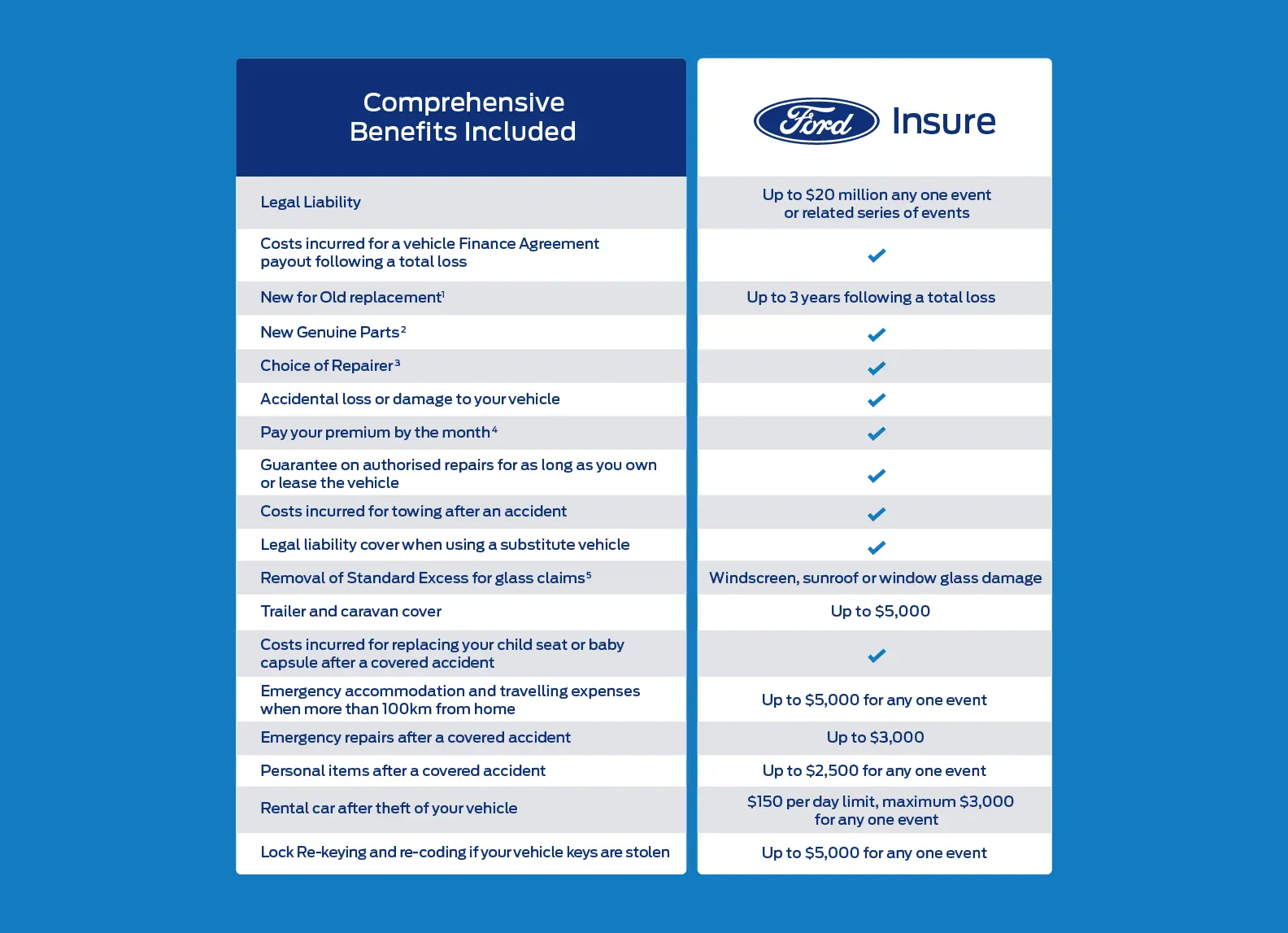

Because it’s made specifically for your Ford, it offers these key features to restore your car to how it was before the accident:

Optional Benefits you can add

✓ Rental car following an accident – $150 per day limit, up to $4,500

✓ Coverage for items used for sporting or leisure6 – Up to $5,000 for any one event

✓ Removal of Standard Excess for tyre claims – 3 replacements or repairs in any one period of insurance

✓ Tools of trade cover – Up to $5,000 for any one event

Available at participating Ford Dealers. Retail and Small business customers only. Eligibility for customer or vehicle is subject to meeting the Ford Insure underwriting criteria and will be determined according to personal circumstances. To check eligibility, contact Ford Insure on 13 FORD (3673).

Insurance Enquiry

Security *

1 If your new vehicle is within 3 years of the first registration and is involved in a claim that is assessed a Total Loss, it may be replaced with a new vehicle of the same make and model, where a replacement vehicle is available. If the same make and model is not available, the Insurer may replace your vehicle with the nearest equivalent or suitable replacement. Refer to the Ford Insure PDS for full details.

2 Some insurance companies may use repairers that could use non genuine parts to repair your vehicle. If your claim is accepted the insurer will use Genuine Parts when available. If not available, the insurer may use genuine reconditioned or recycled parts or ADR certified new, recycled or reconditioned parts. Refer to the Ford Insure PDS for full details.

3 The Insurer may authorise repairs at your repairer of choice; pay you the reasonable costs of repairing your vehicle; or move your vehicle to another repairer that is agreed upon. Refer to the Ford Insure PDS for full details.

4 Premiums are payable annually or monthly, subject to minor adjustments (upwards or downwards) due to rounding and financial institution transaction fees apply. Refer to the Ford Insure PDS for full details.

5 Automatic removal of your standard excess on glass damage means the Standard Excess will not apply if you sustain a loss where the only damage to your Vehicle was glass damage. Refer to the Ford Insure PDS for full details.

6 Lifestyle Extension provides coverage for your bicycles, camping gear and other items used for sporting or leisure, max $5,000 any one claim. Refer to the Ford Insure PDS for full details.

This insurance product is arranged by Ford Australia or your authorised dealer acting as a distributor of WTW for this product. In arranging this insurance, Ford Australia and your authorised dealer act on behalf of WTW and not as your agent. You should review and understand the WTW FSG. If you purchase this insurance Ford Australia and your Dealership will receive a commission from WTW. For further information or assistance please go to www.ford.com.au/Insurance or call us on 13 FORD. While all reasonable skill and care has been taken in preparation of this it should not be construed or relied upon as a substitute for specific advice on your insurance needs. The advice is not based on your personal objectives, financial situation or needs. Accordingly, you should consider how appropriate the advice is to those objectives, financial situation and needs before acting on the advice and, before buying the product, you should read the current Product Disclosure Statement (PDS) and Target Market Determination (TMD) prepared by the insurer, HDI Global Specialty SE – Australia, ABN 58 129 395 544, AFSL 458776 (“HDI”). Both the PDS and the product TMD are available at wtwco.com/fordinsure. WTW are acting as agent of HDI under a binding authority agreement. If you purchase the insurance product WTW will receive a commission and benefits from HDI. These fee...